As per Nibusinessinfo, “risks refer to the viability of a business. It refers to the ability to turn a profit and cover operating expenses like salaries, rent, office expenses, and production costs.”

It is the reason around 60% of startups fail in the first 3 years. Even though many new unicorns buzzing around the country, startup failures are still a common phenomenon. Out of this, consumer travel companies and live events were the most affected industries. And the least affected of them are the restaurants and cafes.

And while these statistics may not be encouraging, starting a business has always been challenging. However, you should not be discouraged. You can safeguard your business by boosting the bottom line and ensuring strong financial support. Startup business loans provide that support to seed and growing startups. However, it is critical to understand the loan usage before availing of it. It is especially important if you are availing one with bad credit.

How do startup loans for bad credit work?

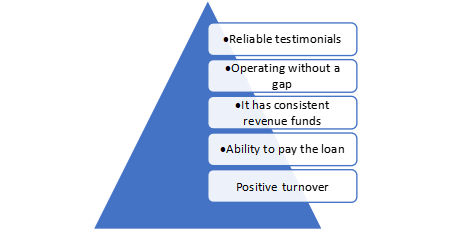

Startup loans for bad credit are for new or initial-state businesses lacking good credit scores to qualify with mainstream lenders. Lenders may disapprove the loan due to low operational history, low or limited credit history, or unstable revenue.

Here, these startup loans for bad credit help the firms get the needed business finance for purposes like- inventory updates, investing in the idea curation, ensuring new advanced technologies for further research, product development, and testing, etc.

A Business may get a loan even at a low credit profile if-

Can you get Guaranteed startup loans for low credit?

No, no lender can guarantee a loan without conducting the needed checks. If you meet the basic criteria, you may get startup business loans for bad credit for guaranteed approval in the UK. However, for this, you can take a few measures before applying:

- Reduce credit utilisation ratio

- Dispute errors and report them

- Understand the documents requirements

- Add a co-signer on the loan if you need a loan urgent

- ensure a stable revenue

- work on client retention

What are the potential startup loans risks and how to avoid them?

Startup loans can be beneficial in many ways like- helping you finance the need without waiting to get the client’s payment or missing the opportunity. However, there are some risks that you should be potentially aware of before applying for the loan.

Below are some risks and possible solutions to reduce the impact:

1) Sudden business closure and debt

As mentioned in the introductory part, only a few businesses survive the competitive scale. If you took a startup loan to finance your business needs and it enters into a loss. You may have negative business equity. This may happen if the interest rates and other charges are more than the business’s worth.

SOLUTION: Analyse the stage the business is in. Identify other ways to finance – crowdfunding or angel investors in the initial stage. If you need a loan, know the costs. It will help you decide whether you can pay the loan comfortably. Factor in- no business months or slow months; if it is a seasonal business.

2) Non-repayment may impact the credit score

Missing a few payments on your startup loans may increase the overall interest rates. It may lead to additional late fees and credit loss. You may pay more than you ought to here.

SOLUTION:

Analyse your capital engagements and check how much you can save per month for repayments. If you cannot pay the loan, try to pay at least half the sum. Startups encounter many unexpected moments where you need to tap capital.

In this case, you share the high chance of missing the payments. By paying the amount you can comfortably afford, you can save your credit and the impact would be low. If you want to pay the full, check whether you can finance the need using urgent loans for bad credit from a direct lender or not.

These loans help a business deal with sudden expenses without worrying about credit scores or credit history. One may qualify for the loan with consistent revenue proof, a great business plan, and the potential to afford the payments. These are short-term loans that are highly ideal for short-business needs.

Alternatively, it is ideal to wait until you build a credit score. It is better than impacting it due to a new loan. A default impacts both business and personal credit scores to an extent.

3) Risk of interest rates fluctuating high

If you borrow startup loans for bad credit at variable interest rates, you receive mixed results. If the economy is good, you may benefit from low-interest rates. Likewise, the interest rates may rise if the economy slows down.

That’s why it is always ideal to opt for fixed interest rates on business loans. It eliminates stress and helps you budget for the repayments.

SOLUTION: Deciding between the two options may not be all white and black. It depends on your business’s performance and revenue. Apart from that, it also depends on the purpose, risk tolerance, cash flow, and the business’s short and long-term goals.

- Venture capitalists require equity in the business

If you approach an investor and he likes the idea, he may ask for equity or profit percentage in the company. Though an investor helps grow a business and helps take important business decisions, one should improvise.

It may make the company take on a new vision or take on growth. You would have to keep the profit and loss statements clear before the person. It may not be ideal for the base of the company or confidentiality.

Alternatively, if you encounter a business loss, you should provide the investor’s share. It means you would not be able to pay the dues with your assets.

SOLUTION: A business should be visionary about its initiatives and finances. If you see yourself applying for a business loan, calculate an apt percentage to provide as equity. If it hinders your capital hut, move out of the agreement.

- May end up exhausting funds before meeting the goal

Limited working capital motivates a startup to budget and work within the means. Easy access to startup funds may dissuade and imbalance the whole picture. You may end up using the funds to cover any immediate requirement than the purpose itself.

SOLUTION: Before taking any loan, always ensure to keep the funds separately. It is legally important to use the funds for the purpose you took it for. If you want more, you can check whether the lender provides a redraw facility or not.

Bottom line

These are some major Startup loan risks and the possible solutions to them. You can finance your business requirements better if you know the risks as well. Always improvise on the pros and cons of any external facility before applying.

Anna Johnson has more than 11 years of experience in direct lending industry of the UK. She is the Senior Content Editor at 24cashflow where she is leading a large team of loan experts. During her career, she has helped the loan aspirants to use the particular loans in the best way and improve their financial lives and status.

Anna Johnson is known for her in-depth research of the UK loan marketplace, as she has worked with many major lending firms in her career. During her educational phase, she has done a research on ‘Finance Fundamentals for Growing Business’.