Are you having anxiety because of poor credit scores? You cannot focus on creating a stable financial state when your credit history remains blemished. It is a clear indication that financial issues are still pending.

You must pay attention to them first before chasing financial goals. Credit improvement is the only safe way to free up cash from the tangles of debts. You might think that lenders are offering financial help despite poor credit.

Then, what is the need for credit improvement? Imagine you are running a company and need funds on the go. You can drop by online lenders to apply for quick business loans without credit checks in the UK.

These loans seem easy to obtain as no hard assessment will take place. However, you cannot take advantage of a loan time and again. You cannot convince the lender if you already have a loan debt to settle.

For this reason, you must try to upgrade your credit scores by doing whatever is possible. No need to worry, as this blog is going to represent some of the proven ways to achieve this purpose.

Elevate your credit scores to become financially independent

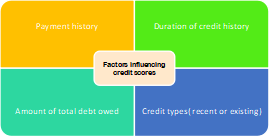

Before getting started with the process, you must pay attention to the elements that are responsible for influencing your scores. Knowing them lets you stay alert about what can go wrong in your credit handling system.

These are the four factors which are responsible for altering your credit scores. The weightage on payment history is 35%, debts are 30%, the span of credit history is 15%, and credit types are 10%. Here, the remaining 10% goes to new credits, which might send a message about your dependence on external funding.

Now, you may dive into the strategies that can curve the path for your credit improvement journey.

1. Check whether you have a credit rating

First, check whether you have done something to create credit scores. Chances are high that you might have a zero credit history. This happens when you have not borrowed money before.

In addition, you have no credit history if you have not paid any bills yet. Although borrowing might seem like an essential step to creating a credit history, you cannot explore financial opportunities without credit scores. Having some scores in first place is critical.

2. Gather reports from different bureaus

Different credit reporting agencies indeed show different scores. However, they are too different, and you can have an idea if everything is all right in your profile. Too much disparity might be an indication that something is wrong.

This will encourage you to explore further to find out the exact reasons for poor credit scores or very low scores. You can fetch a free report twice yearly. Make the most out of this opportunity to keep track of your credit history.

3. Get loans from a direct lender

If your credit scores are questionable, traditional lenders might reject your application. However, you can approach direct lenders regardless of your credit scores. They do not mind offering help to someone like you striving hard to manage with poor credit scores.

Utilising their loans, you can pay off the pending dues. This payment will help you to upgrade your scores. Therefore, getting loans for bad credit in the UK from a direct lender should not necessarily be a bad idea always.

4. Use a direct debit facility for payments

If you have a forgetful nature, chances are there that you may forget about essential payments. You have to face the worst impact because of this behaviour. Late fees and penalties will be imposed, and you cannot do anything about it.

What you can do instead is opt for direct debit. It will facilitate the automatic transfer of money from your account to the designated bill payment account. No matter if you still cannot remember the important dates of payments.

The bill payments will take place once you activate this service. Just make sure to carry enough money in your bank account for smooth payments.

5. Find out about interlinked accounts

At times, you forget about joint accounts that you had with someone close. If you applied for loans using that account many years back, it will be reflected in your credit history. This means everything that has been done to this account can impact your credit scores.

If your partner has a poor credit history, you will have to bear its burden as well. In that case, contacting the credit rating agencies will be a smart move. Besides, you must try to set yourself apart from this account if you no longer need it.

6. Do not apply for multiple loans at the same time

Lenders perform hard checks to make sure about your credit history. Therefore, if you apply for multiple loans at the same time, it will have the worst impact on your credit profile. It will also establish the fact that you rely too much on loans.

Loan providers consider this behaviour to be risky. They might think that you do not have any savings or income to sponsor your payouts. They cannot make sure if you can repay loans that they approve.

7. Try to downsize the amount of debts

Because of financial problems, you might have to accept some debts. However, if you do not try to get rid of them with time or else, it will be a big red flag in your financial profile. Do not worry, as eliminating debts is not difficult.

You do not have to borrow money as well. All you need to do is to follow a strict budget. If the level of debt is too high, you must focus on expenses, which are a priority.

It will allow you to save money extensively so that you pay more towards the debts. Once the debt amount starts lowering, your credit scores will show signs of improvement.

The bottom line

One of the low-key ways to deal with credit scores is by checking for errors in the credit reports. These mistakes are responsible for tarnishing your credit history.

Anna Johnson has more than 11 years of experience in direct lending industry of the UK. She is the Senior Content Editor at 24cashflow where she is leading a large team of loan experts. During her career, she has helped the loan aspirants to use the particular loans in the best way and improve their financial lives and status.

Anna Johnson is known for her in-depth research of the UK loan marketplace, as she has worked with many major lending firms in her career. During her educational phase, she has done a research on ‘Finance Fundamentals for Growing Business’.