The gig economy offers us the freedom to choose when and where to work.

Finances. Yeah, it’s a bit of a roller coaster for gig workers. Sometimes the money flows in, and other times it’s more of a trickle. So, addressing financial challenges? That’s a big deal.

Here’s why:

- Income Uncertainty: Gig work is often project-based. No guarantees about the next gig or its pay.

- Budgeting: With fluctuating income, planning expenses becomes a bit tricky.

So, as we navigate this realm of gig work, we must acknowledge both the hurdles and the gold mines.

Financial Challenges Faced by Gig Workers

The world of gig work can be thrilling. The autonomy, the flexibility, but wait, it’s not always sunshine and rainbows. Gig workers face some unique financial challenges.

Irregular Income and Cash Flow

The nature of gig work income can be quite a rollercoaster ride. One month, you’re on a high with back-to-back gigs and substantial earnings. Next, it’s a ghost town with minimal work and a lean paycheck. This unpredictability can make budgeting and planning a tad stressful.

Understanding the nature of gig work income

Gig work is project-based. Sometimes you’re swamped with jobs; other times, it’s the quiet period. This ebb and flow mean your income will fluctuate. It’s part of the package.

Strategies for managing fluctuating earnings

Now, here’s a million-dollar question. How do you manage this swinging pendulum of income? Here are a few tips:

- Budgeting: Plan for your expenses based on your leanest month, not the richest.

- Saving: Create a buffer. When the money is good, save for the not-so-good times.

Lack of Employee Benefits

Traditional jobs come with a package. Healthcare, retirement, sick days, and more. But for gig workers, these perks are often missing.

Comparison with traditional employment benefits

In a conventional job, employers contribute to your healthcare and retirement plans. You get paid leaves and workers’ compensation. But in the gig world, these safety nets are absent.

Seeking alternative solutions for healthcare, retirement, etc.

So, what can gig workers do? It’s all about finding alternatives:

- Healthcare: Look for independent insurance plans.

- Retirement: Consider Individual Retirement Accounts (IRAs) to secure your golden years.

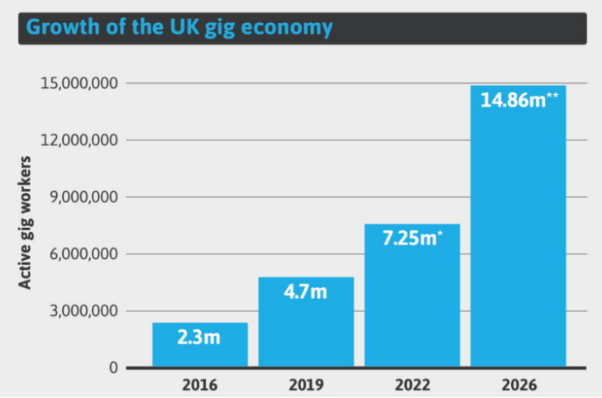

The number of gig workers in the UK has increased significantly in recent years, from 6% of working adults in 2016 to 17% in 2023, reaching an estimated 4.4 million people. By 2024, this figure is expected to rise to 7.25 million, or 22.1% of the workforce.

Debt Management

Juggling debt repayment with fluctuating income is another challenge that gig workers often face.

Balancing debt repayment with irregular income

It can be tough. One moment, you’re ready to make a hefty repayment on your loan, and the next, you’re wondering how to make ends meet. Let’s take the example of urgent doorstep loans.

These short-term loans can be a lifesaver for gig workers who need quick cash. But remember, they’re like double-edged swords. They are handy when you’re in a pinch, but they must be managed well.

Strategies for reducing and managing debt effectively

The goal is not to let debt spiral out of control. Here are some strategies:

- Plan: Prioritise your debts. High-interest loans like urgent doorstep loans should be on top of your list.

- Budget: Allocate a portion of your income to repayments, even in lean months.

Overcoming Financial Challenges and Capitalising on Opportunities

Risk Shields and Navigating Money Storms

Unravelling the insurance maze

Life can throw curveballs. But, with the right insurance, you can hit them out of the park.

- Check out health, disability, and professional liability options.

- The golden rule? Find a plan that fits your pocket and your life.

Dodging financial hiccups

With its income swings, the gig economy can feel like a tightrope walk. How do we stay balanced?

- Backups: Insurance, emergency funds. These are your balancing poles.

- Debt plan: Keep your debts in check. No one likes a surprise debt mountain.

Where are gig workers located in the UK?

| Region | Percentage |

| London | 21.0% |

| East of England | 12.6% |

| South East | 16.0% |

| North West | 13.8% |

| Yorkshire and the Humber | 16.3% |

| West Midlands | 16.6% |

| Scotland | 14.0% |

| East Midlands | 9.4% |

| South West | 13.6% |

| Wales | 14.7% |

| North East | 16.2% |

| Northern Ireland | 14.9% |

Golden Years Planning and Money Growth

Charting the path for after-work life

Think retirement planning is just for regular jobs? Not quite. As a gig worker, you’ve got options too. Look into IRAs, solo 401(k)s. They’re like money seeds for your future.

Growing your money

Investing can seem like a language of its own. But it’s just another way to put your money to work. Consider stocks, bonds, and even real estate.

Oh, and here’s a pro tip: instalment loans for bad credit direct and no guarantor from lenders only can be a lifeline when you need quick funds. You see, financial bumps are common in the gig economy, and sometimes you might need a bit of extra help. These loans can provide that, giving you breathing room to keep focusing on your goals.

Your financial journey as a gig worker doesn’t just stop at managing the present. It extends into future planning and capitalising on growth opportunities. Retirement and investments? Not daunting, just doors to financial empowerment.

According to the Office for National Statistics, the gig economy generated £20 billion in 2019, equivalent to the aerospace industry.

Navigating Finances with Expert Guidance

Perks of Professional Advice

Think of financial advisors like your personal finance GPS. They’re there to help you avoid wrong turns and reach your destination faster.

- They get you: Advisors can tailor strategies for the unique gig lifestyle.

- They save you time: No more guessing or stressing. They’ve got your back.

How They Polish Your Financial Game Plan

Financial planning can be like putting together a jigsaw puzzle. Experts help you see the big picture.

- They align your money moves with your goals: Want to buy a house? Retire at 50? They can map that out.

- They’re up-to-date: Tax laws, investment trends, you name it. They keep you in the know.

Tackling finance challenges as a gig worker isn’t a solo mission. Professional advisors can be your co-pilots, guiding you towards financial victories. Their expertise takes the guesswork out of managing money.

Conclusion

No doubt, the gig world’s a different kettle of fish. Think see-saw earnings, no work perks, and money matters all to us. It’s a wild ride. But guess what? We’re drivers, not passengers. We can steer this ship.

What’s our compass? It’s smart money moves. We’re talking bendy budgets, money buffers, dreaming of retirement life, and growing our bucks. We’re talking about ringing up money pros when we need a hand. It’s about peering into the future and pulling it closer.

Anna Johnson has more than 11 years of experience in direct lending industry of the UK. She is the Senior Content Editor at 24cashflow where she is leading a large team of loan experts. During her career, she has helped the loan aspirants to use the particular loans in the best way and improve their financial lives and status.

Anna Johnson is known for her in-depth research of the UK loan marketplace, as she has worked with many major lending firms in her career. During her educational phase, she has done a research on ‘Finance Fundamentals for Growing Business’.