The costs at weddings just seem to keep inflating from one year to the next. What once was the percentage of a family that made up the bulk of salary is now the primary use of the income spent by most couples. Places, food, outfits, which include a photographer and other extras are quickly remembered after they were paid for.

It is imperative to note that with such a high cost of living, staying within a budget and setting aside a realistic budget is a must. Decide what wedding ceremony approaches are the most pertinent and must be met over those that are non-essential.

Proper budgeting helps you to avoid ending up with a lot of debt and overspending. It helps you save money and provides financial security during the early stages of your married life.

How Much Does the Average Wedding Cost?

Weddings are joyful but pricey events. A 2023 survey found the average UK wedding costs £19,184. Adding an engagement ring and honeymoon brings the total to over £24,000! High price tags for such a special day.

To help pay, many couples use wedding loans. In April 2024, lenders offered loans from £7,500 to £15,000 for weddings. These loans can cover a big portion of average total costs.

If you need money quickly for any reason, doorstep loans are an option – but beware. Doorstep lenders bring small, short-term loans right to your home once approved. You repay weekly or monthly over a few months.

Only borrow what you can repay based on your income. Make a budget first. Or see if local nonprofits or government aid can help pay some bills instead.

Benefits of Using Savings

Paying with savings means no new debts! When the wedding ends, you move forward debt-free. You keep all the joy, minus financial strain. Your life together starts with clean money slates. Zero interest charges eat into family funds.

Not owing lenders frees up income for goals. Save for a home, kids’ college funds are easier. More cash flows toward dreams and needs. You control your united finances without obligations. Financial freedom feels amazing as newlywed partners!

Comparing Costs

A loan’s interest accumulates over years of payments. That added cost makes weddings more expensive long-term. With savings, you avoid interest charges altogether. Smart saving means the wedding’s true cost equals…just the wedding!

Your patient savings can also grow over time:

- Interest earned in savings accounts

- Potential investment growth if saving started early

- Added funds from tax refunds or work bonuses

Here’s an example comparing costs:

| Loan Details | Savings Growth |

| Amount: $20,000 | Initial Amount: $5,000 |

| Interest Rate: 8% | Annual Contributions: $3,000 |

| Term: 5 years | Investment Return: 6% |

| Total Cost: $24,672 | Total After 5 Years: $21,368 |

Impact on Credit Score

Loan Repayment History

Paying a wedding loan on time helps build credit over the years. Those steady payments look great on reports, proving responsibility. But missed payments mean negative marks hurting scores.

Extremely bad credit loans can feel like life rafts when scores sink low. Getting – and repaying – these loans shows lenders you’re serious about credit rebuilding. On-time payments gradually lift scores from rough spots.

Credit Utilisation

A big loan maxes out credit limits at first, which hurts utilisation ratios. Lenders prefer low balances compared to total limits. As payments whittle loan amounts down over time, those utilisation ratios improve.

| Credit Used | Utilisation Ratio |

| $2,000 | 10% |

| $6,000 | 30% |

| $12,000 | 60% |

| $18,000 | 90% |

Lower is better for utilisation! Under 30% looks best.

Risk of Starting Marriage in Debt

Beginning a marriage already owing thousands adds financial strain. Those loan payments divert funds from new household needs like:

- Saving for emergencies

- Budgeting for new yearly costs

- Planning for big goals like housing

Financial Stress

The burden of loan debts can feel overwhelming. Money arguments are a top cause of conflicts in marriages. Unnecessary financial stress damages relationships from the start.

Long-Term Financial Goals

- Buying a home or rental properties

- Funding children’s education

- Building robust retirement savings

- Pursuing entrepreneurship or career pivots

Debt limits what’s possible. But starting marriage debt-free lets you:

- Allocate money more meaningfully

- Take measured risks for bigger dreams

- Achieve long-term goals faster, wealthier

Building a Realistic Wedding Budget

The first step is picking what matters most. Every couple has their own dream wedding ideas. Talk openly with your spouse about your visions. If you disagree on things, find a middle ground. Know your top priorities from the start so you don’t spend too much on unimportant extras.

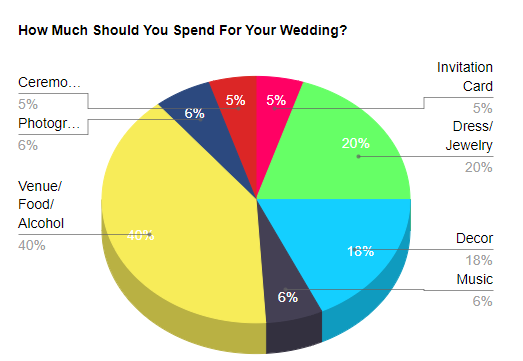

Key Wedding Costs

You’ll need to pay for the place, food, photographer, outfits for the wedding party, flowers, music, favours, and transportation. Once you know your must-haves, split costs into necessities and nice-to-haves. Pay for the essentials first. Then use any leftover money for special touches.

Other Money Sources

Ask family if they can chip in before getting loans! Loved ones often want to help cover portions as gifts. But be up-front about expectations so no one feels owed later.

Some couples use personal loans for weddings. These come from banks, credit unions or online lenders – not just those marketed as “wedding loans.” Shop around for best interest rates and fees. A co-signer can qualify for better terms.

Loan Options:

| Loan Type | Interest | Upfront Fee | Payback Time |

| Bank Personal | 8-14% | 0-5% | 1-5 years |

| Credit Union | 6-18% | 0-3% | 1-5 years |

| Online Lender | 6-36% | 0-8% | 2-7 years |

| Wedding Loan | 7-35% | 0-5% | 1-7 years |

Avoid lenders with high rates or fees, even if their ads look good.

After adding up costs, you may need to rethink things. Focus on your top priorities, even if it’s not the exact wedding you dreamed of. A smart budget now prevents money regrets later.

Considering Time to Repay

Loan Repayment Timeline

Most wedding loans must be paid back within 5 years. That’s 60 monthly payments on top of other new bills. More interest piles up the longer you stretch repayment. A short timeline means higher payments but less total interest cost. A longer timeline gives lower payments but more total interest paid.

Savings Accumulation Period

Saving for a wedding takes patience and discipline. Most aim for 1-3 years to accumulate needed funds. The more runway, the lower the monthly savings goals. But longer wait times risk changing life plans. Build a realistic timeline based on estimated costs and monthly savings capacity after other expenses. Automate transfers so funds grow without effort.

Conclusion

Every couple must weigh the pros and cons based on their unique situation and communication. Some choose to take out loans, while others save diligently to cover costs with cash. A combination approach could work too.

Taking out a loan provides flexibility to have your dream wedding now. But it also means paying interest charges over years after the event. Saving up allows you to start marriage debt-free. However, patience is required to accumulate sufficient funds over time.

In evaluating your current finances honesty is key. How much can realistically be saved each month? How much debt is already owed? What are your salaries, expenses, and future goals? Crunching the numbers reveals which wedding payment approach aligns best with your circumstances long-term.

Anna Johnson has more than 11 years of experience in direct lending industry of the UK. She is the Senior Content Editor at 24cashflow where she is leading a large team of loan experts. During her career, she has helped the loan aspirants to use the particular loans in the best way and improve their financial lives and status.

Anna Johnson is known for her in-depth research of the UK loan marketplace, as she has worked with many major lending firms in her career. During her educational phase, she has done a research on ‘Finance Fundamentals for Growing Business’.